Every quarter, earnings calls provide investors with an opportunity to gain additional insights into company performance. The discussion of financial results between executives and investors discloses hard information that is widely used in the fundamental analysis of a company.

Incorporating Earnings Calls transcript data provides an opportunity to uncover additional alpha. We built three independent trading signals from the data, and found that:

-

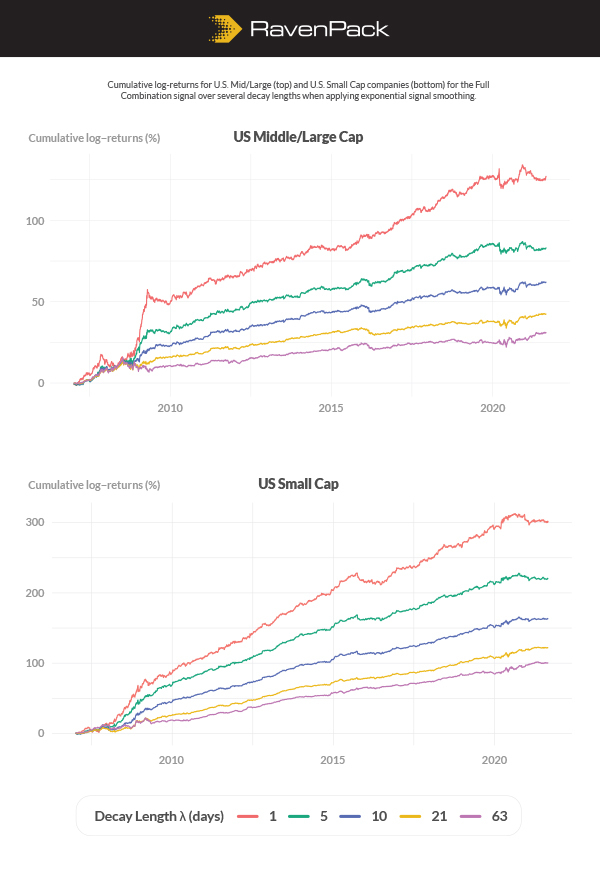

Document Sentiment is a strong standalone signal, with Information Ratio (IR) above 1.1 for US Mid/Large Caps and upwards of 2.0 for Small Caps over holding periods of up to 1 week, or above 1.0 and 1.7 for holding periods of about 1 month.

-

Combined with two other signals, Event Sentiment and a Transparency Score, the IR increases to 1.4 for US Mid/Large Caps and 2.3 for Small Caps for shorter holding periods. Monthly holding period IR for U.S. Small-Caps increases to 2.0.

-

Combining transcripts data with RavenPack News Analytics enhances the performance of U.S. strategies across nearly all holding periods, providing a valuable addition to existing datasets.

RavenPack Earning Intelligence

RavenPack Earnings Intelligence combines signals from separate sources augmented with sentiment and thematic analytics for a powerful alternative that removes the limits of isolated vendor data. For more information, visit: https://www.ravenpack.com/earnings-intelligence

About RavenPack

RavenPack is the leading data analytics provider for financial services. The company's clients include the most successful hedge funds, banks, and asset managers in the world.

Request White Paper